Learn how JustUs (previously eMoney Union) uses DirectID to provide same day loans and reduce fraud attempts by 75%.

Who are JustUs?

JustUs is a cutting edge peer-to-peer lending platform helping credit-challenged consumers find responsible and affordable capital while delivering consistent returns to lenders. The platform has processed more than £120 million of loan applications and is growing fast, requiring a technology partner to help accelerate core business needs.

As a peer-to-peer lender, minimising risk is crucial - JustUs must ensure that borrowers repay their loans and that platform lenders earn positive returns. As a result, the company turns down as many as 99% of all applicants. This means that it must process and assess a high volume of applications quickly and accurately, all while meeting responsible lending guidelines.

What does JustUs use DirectID for?

1. Speed Of Conversion

Historically, JustUs has relied on traditional background credit checks to prove identity and assess risk, requiring applicants to upload or mail in identity documents and bank statements. With DirectID, JustUs can now connect to an applicant’s online bank account with their approval to verify identity and review live bank statement transactions in just a few seconds.

JustUs’ real time account review and confirmation of ability to pay enables faster decisioning time, and ultimately more loans being processed to negate the company’s high decline rate.

Using DirectID we can fund a loan application with confidence in the same day.” – Lee Birkett, CEO

2. Credit Assessment Accuracy

DirectID provides JustUs with a competitive advantage: the ability to approve low credit score borrowers - like students with limited histories or underbanked families - that are traditionally shunned by other lenders. When borrowers and lenders alike share their bank statements, JustUs gets direct, read-only access to the last 90 days transaction data. These real-time, certified bank statements, coupled with bank-verified identities, provide much deeper insights into who is both creditworthy and trustworthy. The result of all of this lead to a reduction of fraud attempts by 75%.

Bank statements don’t lie. With DirectID, the credit decision and ID is immediate and obvious.

3. Commitment to being Responsible Lending Champions

JustUs takes its commitment to being a responsible lender seriously. The company works closely with the Financial Conduct Authority (FCA) to maintain its favourable standing. By using DirectID, JustUs can document its underwriting decision and affordability decisions and the proving of a borrower’s ability to pay to a much greater level of detail and transparency than ever before.

DirectID bank statement information proves our rigorous underwriting standards for regulators.

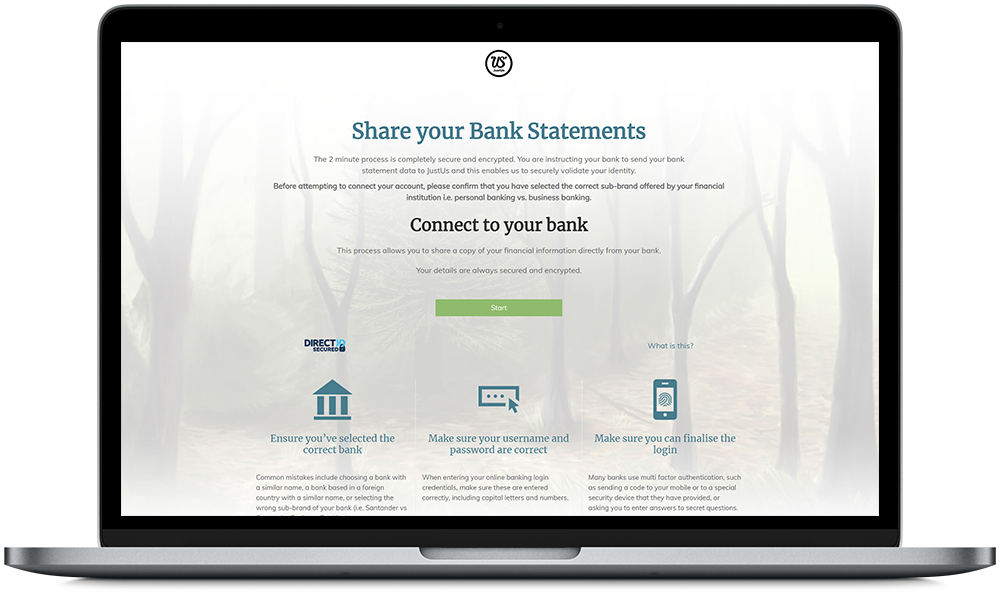

How It Works

JustUs uses the DirectID hosted solution, which provides full branding, customisation and set up. It allows businesses to get up and running fast, without having to involve their own IT department. Once an applicant passes JustUs' first round of checks they receive a link for verification through JustUs' hosted DirectID site. They then connect to their online bank account, using their secure credentials, to verify their identity and share their live bank statement transactions in just a few seconds. The underwriting team then review applicants through the DirectID dashboard and reports.

It’s such a light touch integration. DirectID makes it fast and easy to get up and running.

See more of the brilliant work JustUs is doing by visiting their website, or following them on Twitter or LinkedIn.