With everyone talking about Open Banking and Bank Data across the globe, anyone in the financial sector has undoubtedly thought about using it themselves. But there is an immediate brick wall - how?

How do I get a customer to consent to my business viewing their bank transactions? How do I explain why we would like to view them? And how do I then make the request to their bank to actually retrieve all that data?

Getting started with Bank Data shouldn't be difficult. Granted it should be secure, but it should be easy for any business to start with and create better and more innovative products. That's where DirectID Connect comes in.

What is DirectID Connect?

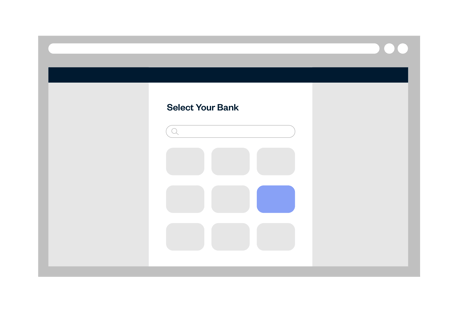

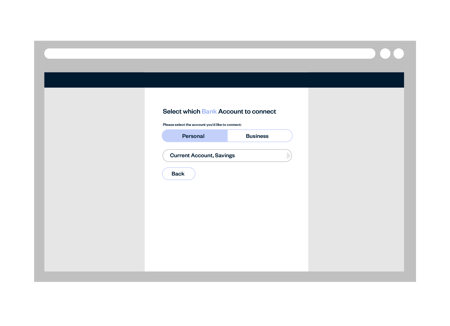

Connect is a widget that allows your customers to:

- Select their bank with ease

- Consent to you having the appropriate access to certain bank data

- Allows them to login to their personal banking

- Securely stores this consent and bank account authentication and provides you read-only access to this bank data directly from the bank

How do you get started with Connect?

With our zero-integration hosted solution you can start sending customers to a dedicated DirectID Connect page made to look and feel like your brand, and providing secure access to bank data. It is optimised for mobile and desktop so your customers get the best experience on any platform.

Alternatively if you want to include Connect directly in your mobile app, business website, or existing application workflow you can simply use our plug and play widget which takes just moments to paste into place.

What makes Connect the right choice?

The team behind DirectID have been working with bank data for over 8 years. Our team comes from a range of financial and technological backgrounds and we have combined our expertise to create market leading products.

Not only is the team world class but our products are already used by customers around the world and in sectors across the financial industry. We aren't a start-up trying to build the right solution, we know we have the best.

Our widget has had leading UX designers working with clients and their customers from day one, optimising and improving, breaking and building, until the best possible user experience was created. We will never stop working to improve the experience but we already know our widget is leading the charge for seamless customer onboarding and increasing business conversion rates.

What business advantages do you get from implementing DirectID Connect?

1. Technical capacity isn't a barrier

Technical capacity is no longer a barrier to using bank data. With DirectID's fully hosted solutions, you can start assessing live customer date in less than a week.

2. Increase customer conversion.

Remove paper statements and digital PDFs over emails from the equation. Use Connect to let customers provide financial data in a few clicks.

3. Modernise your customer experience.

Create a modern digital experience for your business with our widget giving you the edge over competitors no matter your business goals.

4. Reduce application fraud.

Don’t risk fraud from paper or PDF applications. Let customers consent to direct bank data being provided so you can make confident decisions.

5. Make applying simple.

With our widgets global leading UX design you’ll provide the best and easiest consumer experience to increase conversion.

6. Offer mobile friendly process.

Whether users are using your app, website, or mobile website, our widget will make your process seamless as it scales to optimise by screen size.

Once a customer connects, how do you use the bank data?

You have two options for using the bank data your customers consent to provide you. Either;

- Via our simple Data API, a single interface to access all of your customers financial data.

- Or via our Insights solution, a visual dashboard that instantly allows any business to start viewing, understanding, and using bank data.

You can use these products to solve challenges with identity, affordability, credit risk, collections, onboarding, fraud, efficiency and innovation. We even have dedicated value-add solutions that take the data from Connect and perform Income Verification or Bank Account Validation.

All of this is to say DirectID Connect makes getting started with bank data easy. We take care of the data, provide you with the value add-on's to understand it, leaving your business to get on with what is most important - business.

Want to know more about how DirectID Connect could benefit your business?

Click here to Book a Demo, or talk to a specialist about bank data. Our team of experts are more than happy to work through how Connect could fit into your platform, and help you understand the value it could provide to your business model.