DirectID are thrilled to sit down with Product Owner, Helen Stewart, to talk about DirectID Insights.Helen has been instrumental in the development and build of DirectID Insights and perfectly placed to answer all our questions on how it works, what the advantages are, and how lenders can be up and running with Open Banking in less than three days.

DirectID: Why was DirectID Insights developed?

HS: We saw an opportunity to use bank data to solve a key onboarding pain for lenders.

---

DirectID: So what do these inefficiencies look like?

HS: It essentially comes down to the amount of time it takes for the relevant information to be provided to the lender and the effort both the consumer and the lender must exert in procuring and processing that information. So, let’s say someone applies for a loan and the lender asks the applicant to submit three months of bank statements for review as part of the decision process – this is common when an applicant goes through what we call an exceptions process. Basically, there is not enough information provided during the application phase to make a decision and the lender needs more supporting evidence.

In this instance, an applicant must locate their bank statements – assuming they have them and don’t need to request them from their bank – and then post them to the lender. Eventually these bank statements will land on the desk of the Underwriter or Credit Risk Officer reviewing the application. At this point, a new cycle of work starts for the lender.

The Underwriter or Credit Risk Officer has to go through the bank statements with a proverbial toothcomb, looking for evidence of income, regular outgoings, mortgage or rent payments, other spend…with a view to assessing what the applicants discretionary spend is and ultimately whether they can afford the repayments on the loan they have applied for.

---

DirectID: And what does this lead to?

HS: It leads to a lot of time and effort spent for all parties. Firstly, the applicant has to procure their bank statements and get them across to the lender then wait sometimes as long as a week before hearing whether they have been granted the loan. Not a great customer experience and oftentimes that time lag will force the applicant to get the money elsewhere which is a loss to the lender. From the lenders point of view, they have to wait to receive the bank statements, then they need to be reviewed by an Underwriter – there is a big operational cost associated with this process.

---

DirectID: When making a lending decision, how accurate do they tend to be?

HS: Experian estimate that 40% of manual underwriting is achieved through subjective decision making. DirectID Insights and specifically Categorisation removes this guesswork, reduces risk for lenders and results in fairer outcomes for customers.

---

DirectID: Let’s move onto DirectID Insights. What does it do?

HS: DirectID Insights solves the issues we’ve just discussed. It allows an applicant to connect their current account with the lending institution and categorises all of their transactions so that Underwriters do not have to go through each transaction line by line. Lending decisions can be made much more quickly which is great for customers and lenders. Also by removing paper-based bank statements, we remove the risk surrounding the fraudulent manipulation of those documents.

---

DirectID: Sounds impressive! How does it work?

HS: Open Banking allows an applicant to be redirected to their internet banking where they can log in and grant the lender read-only access to their account. We then take this transaction detail and present it to the lender in our dashboard. The data shown in the dashboard is all that is needed to make the lending decision.

---

DirectID: When designing DirectID Insights, what were you hoping to achieve?

HS: As I say, I saw an opportunity to create significant efficiencies in the onboarding phase using bank data. We engaged with a number of customers and worked with Underwriters to determine requirements. That feedback in the design process was absolutely invaluable.

---

DirectID: With Open Banking, how long does it take for a customer’s details to be with an Underwriter?

HS: DirectID Insights allows an investigator to review the important headlines from an applicant’s bank account within minutes. This is a huge time and subsequently operational cost saving.

---

DirectID: What tools does DirectID offer that are helpful to those making loan decisions, besides speed of access?

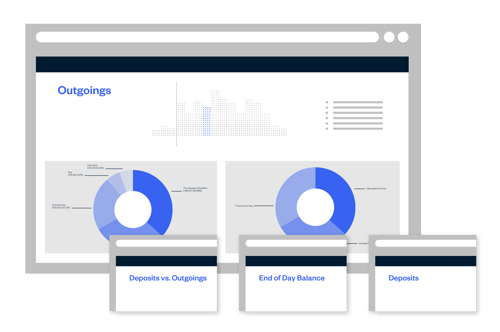

HS: DirectID Insights offers a host of options that are critical for Underwriters and Credit Risk Officers, including Account summary to see an overview of each account; Deposits and outgoings analytics; End of day balances; existing Loan servicing; Gambling analytics and; Transaction Reporting. We provide up to twelve months of bank data for each individual which is Categorised and Classified.

---

DirectID: Sounds like it could be a cumbersome IT project?

HS: No, not at all! One of the best parts of DirectID Insights is that it requires zero integration. No IT team needed at all! We can have customers up-and-running in just a few days, certainly under a week. When I say up and running, I mean having meaningful bank data presented in a dashboard in front of them. The ability to save time and money with DirectID Insights takes less time than it takes for one applicant to send in their bank statements!

DirectID: What dropout rates do you see when you ask customers to use Open Banking?

HS: Asking a customer to connect their bank account requires very little work on behalf of the applicant. It takes the equivalent time it would for them to log into their online banking account versus the time and hassle spent on requesting paper-based bank statements and supplying them to the lender via post. I expect the drop out at this stage to be minimal.

---

DirectID: Where did the inspiration for DirectID Insights stem from?

HS: I worked in banking for a long time and regularly came across some of these problems affecting onboarding in both a product and commercial development capacity.

---

DirectID: So sum up for us the advantages of using DirectID Insights?

HS: In short, for the customer, the application process is now boiled down to logging into your internet banking and granting access to the lender – a massive saving in time and effort.

For the lender, the first benefit is the reduction in drop-out rate, for the reasons that I’ve previously mentioned. Then there’s reducing the time between first applying and the loan funds being deposited in the applicants account.

The next step is being able to present the information to a lender, Categorised and Classified, in an intelligent dashboard, within minutes of the application being made, to an Underwriter. And the final part is that the individual making the decision, now has all the information required. The potential savings in time, money and resource, particularly when utilised at scale, are enormous.

Also, as mentioned before, by removing paper-based bank statements from the onboarding process, we remove any risk of those documents being manipulated in an attempt to change a loan award outcome.

---

DirectID: Helen, thanks for joining us!

HS: Pleasure!